A bill designed to close affordable housing tax loopholes is opening many, many more

The bill seeks to stimulate the construction of low-income housing through 8-Law while seriously jeopardizing municipal tax collection to the detriment of homeowners and renters.

On April 22nd, Providence Mayor Brett Smiley appeared before the House Committee on Municipal Government & Housing to request permission to raise taxes on homeowners (and renters) by more than the 4% increase allowed by law. Providence was in dire financial straits and needed the money to prevent economic disaster.

Around one week prior, when introducing his FY2026 budget to the Providence City Council, Mayor Smiley characterized the tax increase as a sacrifice that every Providence resident had to make. In constructing the budget, the Mayor said, “We had to make sacrifices, and we were faced with difficult decisions.”

But the Mayor isn’t asking all Providence property owners to make sacrifices. For a select few, the Mayor wants the General Assembly’s permission to offer a significant tax reduction.

Seated before the same House Committee on Municipal Government & Housing in early March, Mayor Smiley pushed a bill that would grant powerful and wealthy developers like Joseph Paolino Jr. and Arnold "Buff" Chace significant tax breaks on commercial properties converted to residential units.

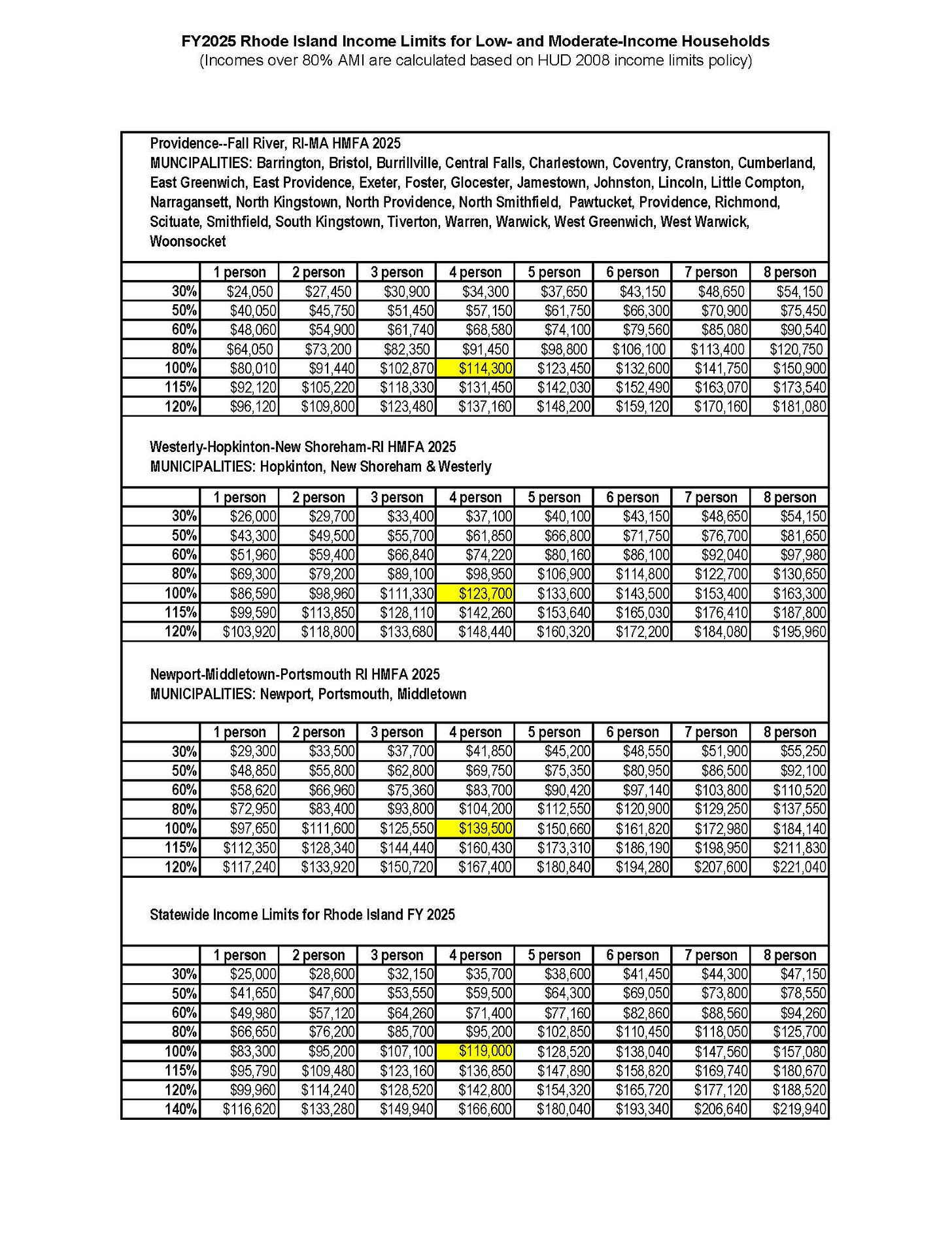

The bill seeks to update and clarify the 8-Law, a tax break for developers who offer low-income housing, set at 80% or less of the Area Median Income (AMI) as established by HUD (United States Department of Housing and Urban Development). I’ve placed a useful chart at the footnote.1 These updates and clarifications are necessary because 8-Law was abused by the Elorza Administration when they granted developer Arnold Chace a secretive sweetheart deal. The Providence City Council has instigated a lawsuit to undo that deal, since only the City Council can amend taxes (through processes like tax stabilization agreements).

H5688

The first half of the 8-Law bill, Section A, would accomplish the goal of updating and clarifying the 8-Law. There is broad agreement among the experts I have spoken to that the legislation will close loopholes and perhaps stimulate more low-income housing development. It’s the second part of the bill, Section B, that is problematic. Section B aims to promote the conversion of commercial properties, such as office space, into residential properties. “We have a looming crisis,” said Mayor Smiley to the House Committee, “which is vacant commercial office buildings.”

Converting unused office space into housing is a commendable idea, but it has nothing to do with creating low-income housing, the sole reason 8-Law exists in the first place. 8-Law is not about developing residential property without regard to cost; it’s about developing low-income housing set at 80% or 60% of the adjusted median income, as established by HUD. Applying this model to commercial property conversion makes no sense, and proponents of this part of the bill are aware of this. That may be why the Providence Foundation 8 Law Task Force has suggested what they call a “compromise” that is no compromise at all.2

In a memorandum, Attorney Robert Stolzman, on behalf of the Providence Foundation, writes:

“The Providence Foundation recommends compromise by adding an affordability component whereby ten (10%) percent of the dwelling units are at levels affordable to households at or below one hundred twenty (120%) percent statewide area median income (AMI).”

In other words, rather than offering residential units at 80 or 60 percent of the Area Median Income (AMI), the Providence Foundation is “compromising” by offering a smattering of units at 120 percent of AMI.

The memorandon continues with a not-so-clever misrepresentation

“We note the 120% AMI level is expressly identified as affordable under the RI Low Mod Act, and is reflected in affordable rental projects through the RIHousing WHIC Program including, but not limited to, the ‘Trader Joe’s’ apartments on Link Street, Case Mead Lofts, and The Studley Building projects.”

120% is the cap for affordable home ownership. The cap for affordable rental units, which is what Section B of the bill under consideration is talking about, is capped at 80%. I’m sure this was an oversight on the part of Stolzman, the very expensive attorney who authored this memorandum, and not an attempt to misrepresent the law, mislead the legislators working on the bill, or lie.

It would be easy enough to separate the current bill into two parts and pass them as separate bills, because the two halves of the bill attempt to do very different things. Cramming commercial conversion into an 8-Law clarification bill allows might stimulate the construction of low-income housing (Yay!) while giving millionaire developers a massive, 30-year tax break on commercial conversions (Boo!)

There are more problems than that, however:

1. There is no economic analysis.

Most bills that pass through the General Assembly have a fiscal note attached, which is an analysis of the estimated cost of the bill if passed. No economic analysis has been done on this bill, which will offer gigantic tax savings that will not expire for three decades. You might think that municipalities (and voters) would want to know how much this legislation is going to cost them.

2. The bill will affect the entire state, not just Providence.

Mayor Smiley, the Providence Foundation, and wealthy landlords (such as Paolino and Chace) are carrying the ball on this bill, using their significant political power to influence General Assembly leadership and get it over the line. However, the bill isn’t only about Providence. If passed, this bill becomes law for the entire state. Other municipalities will be affected. Perhaps Mayor Smiley doesn’t care about the average homeowner in Providence being hit with an increased tax bill while his millionaire real estate friends receive tax breaks, but leaders in other municipalities might. Newport, Woonsocket, Cranston, Pawtucket, Warwick, and more all have commercial properties ripe for residential conversion. Can these municipalities afford these massive tax breaks? Are other municipal leaders ready to place the burden of falling tax levies on their homeowners and residents?

3. The current 8-Law proposal circumvents the city council authority over taxation

Providence recently revamped the way the city does tax stabilization agreements (TSAs). TSAs are tax agreements between the city and developers that allow companies to pay much less than the assessed value in taxes. The idea is that they stimulate development. (Maybe?)

Because TSAs in Providence were previously granted by the city council in ways that seemed more political than fair, the council standardized the process, creating a system where TSAs are granted not on the whims of politicians, but on projects that satisfy a specific set of criteria. TSAs are another form of welfare for wealthy individuals, but at least thecurrent system is an attempt at greater fairness.

However, Section B of the 8-Law bill, which pertains to converting commercial properties to residential, doesn’t follow the TSA process, or any other tax appeal/abatement process. These processes require a public hearing, a finance committee vote and full council vote - all of which are done in public in a (presumably) open and transparent way. What Section B does is give developers a way around the open, transparent, and public process; giving them a tax break through an adminstrative process, in this case the city tax assessor. (As an aside, the 8-Law tax breaks are so good that Arnold Chace gave up his TSAs to make his questionable deal with the Elorza Administration.)

4. The Providence City Council is opposed

Typically, when a municipal leader seeks to have the General Assembly pass a bill, they appear before the committee with a resolution in hand from the city or town council, stating their support for the effort. If the executive and legislative bodies disagree, the General Assembly essentially says, “Go work it out and come back.”

That’s not happening. Instead, the Providence City Council passed a resolution opposed to the 8-Law bill as currently written. Specifically, the city council opposes Section B, which involves commercial conversion to residential use.

However, note that there are powerful and very wealthy forces that want this bill to pass. There is a significant amount of money to be made, and those in favor of the bill are contributing a substantial amount of money to make it happen. Attorney Robert Stolzman works for Adler, Pollack and Sheehan, one of the state’s top law firms. They aren’t cheap.

Instead of telling Mayor Smiley to work it out with his city council, General Assembly leadership, swayed by the Providence Foundation and wealthy landlords (Paolino, Chase, etc.), are seriously considering passing the bill over the objections of the city council.

5. Providence doesn’t need the state to pass this bill.

Changes to the 8-Law and tax breaks for commercial to residential conversions don’t have to go through the General Assembly. The mayor and the city council could work it out and pass it themselves. However, as noted above, the mayor and the city council are not in agreement on the bill, so rather than working it out through negotiation and compromise, Mayor Smiley is making an end run around the process and going directly to the General Assembly. Mayor Smiley, the Providence Foundation, and wealthy landlords (such as Paolino and Chase) appear to believe that General Assembly leadership can be more easily swayed to pass massive tax cuts for wealthy developers than the Providence City Council.

Truthfully, they are probably right to believe that. Several members of the General Assembly have their eyes on bigger roles in politics, and elections are expensive. Doing the Providence Foundation and wealthy landlords (such as Paolino and Chase) a solid can reap campaign contributions in the future, or reward donors who have already contributed.

We need the 8-Law to be updated and clarified. Section A of the bill is good enough and should be passed. We also need a bill to stimulate the conversion of commercial properties to residential. But the current effort, cramming it into the 8-Law bill as a big giveaway to wealthy elites, is not the way to do it.

Dividing the bill into two and assessing each on its own merits is the best path forward. There should be a robust discussion around the commercial conversion to residential use, and municipalities should ensure that the taxes they collect on these properties are fair to both developers and the rest of the taxpayers. Every tax cut provided to the wealthy elite is, in effect, a tax increase or a cut in services for the rest of us. Fairness dictates moving ahead with openness and clarity, but the way this bill is being advanced is wrong.

The mission of the Providence Foundation is “to create an environment that is conducive to growth and sustained investment” in Providence.” The executive director of the Providence Foundation is David Salvatore, a former Providence City Councilmember.

This is a regressive bill for everyone except of course the very wealthy....

Tax breaks for real estate investments by the rich are among the stuidest of all inventions. Even the World Bank and the International Monetary Fudn say the tax breaks for the rich for reaal estate transations do not do anything useful. Interesting the Rob Stolzman is the lawyer on this. This is the same lawyer that had to pay millions over the 38 Studios fiasco and was the lawyer helping the criminals at the RI Economic Development Corporation try to build a $1 billion dollar boondoggle port at Quonset. Needles to say, Stolzman's judgement is very poor and no city or state should take his advice.