RIght from the Start outlines legislative priorities for young children and their families

“We need revenue to support families, that will get our children off to the right start... It is a recipe… not a menu.”

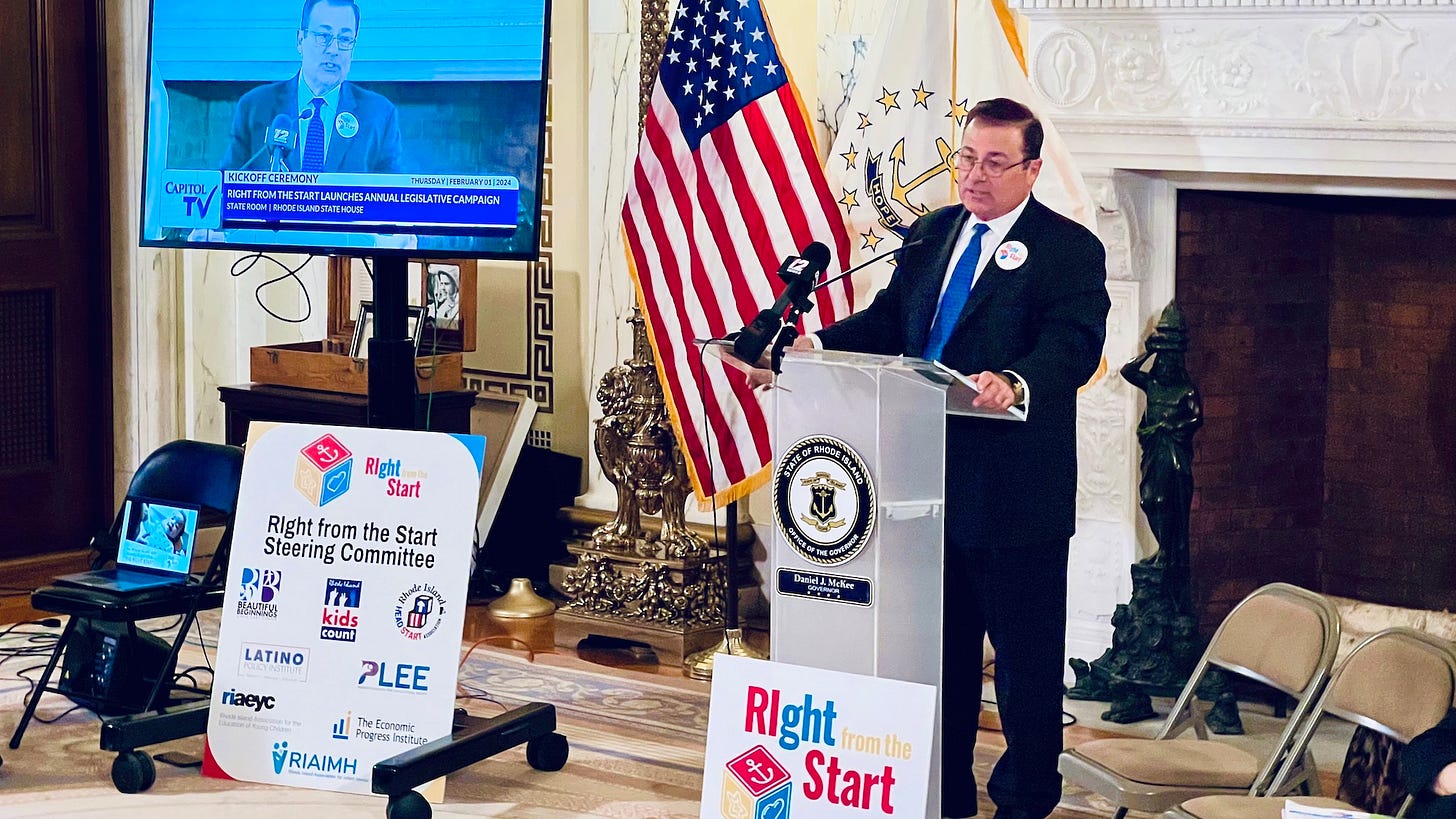

RIght from the Start is a legislative and budget campaign led by eight organizations and coordinated by Rhode Island Kids Count to advance state policies for young children and their families in Rhode Island. On Thursday, they presented their 2024 legislative priorities at an event attended by House Speaker Joseph Shekarchi, the Governor, and the Senate Majority Leader.

“Now that covid funding is ending… we really need to push this year… to support the RIght from the Start agenda,” said Khadua Lewis Kahn, Executive Director of Beautiful Beginnings Child Care Center. “We need revenue to support families, that will get our children off to the right start. Health and development, economic and childcare, we need to support all of them. It is a recipe… not a menu.”

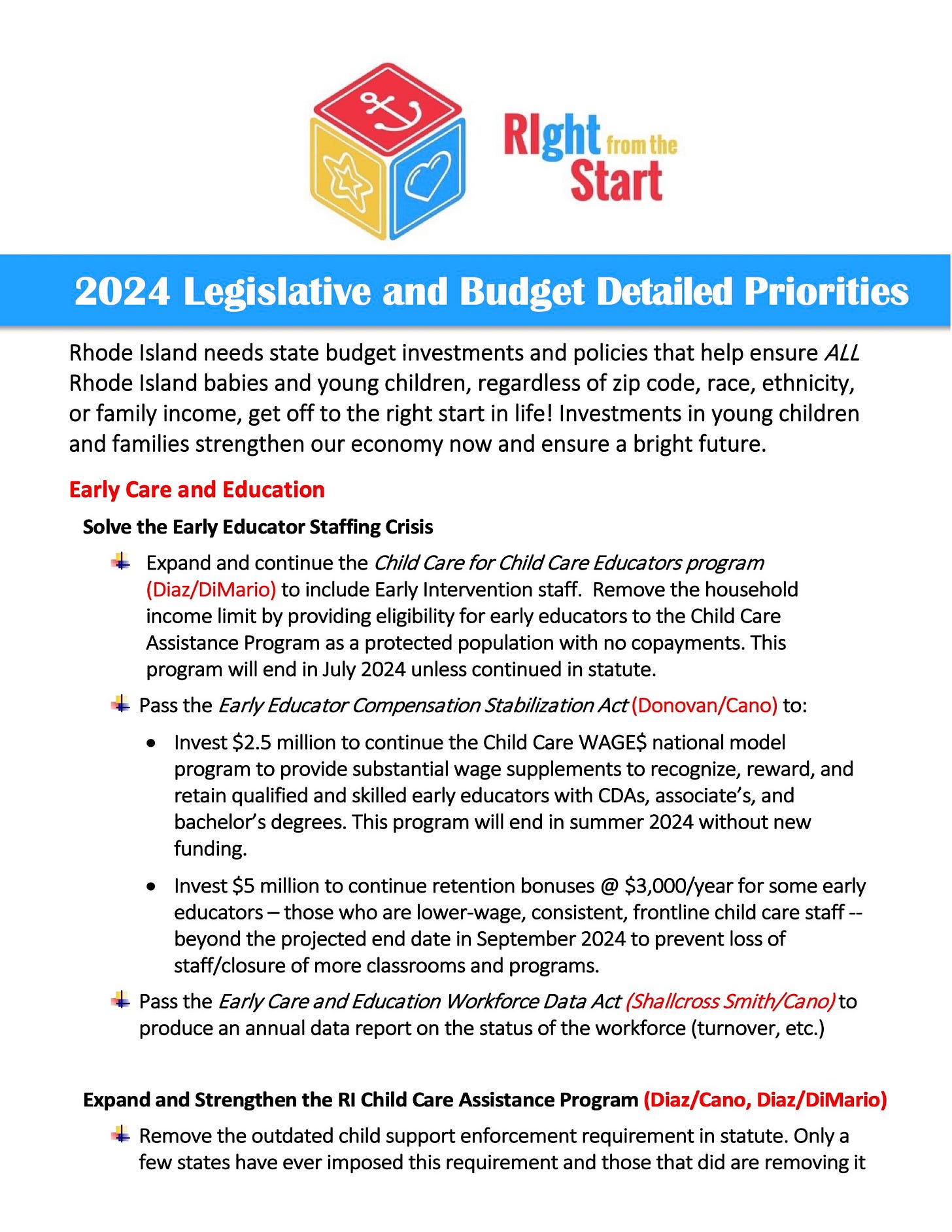

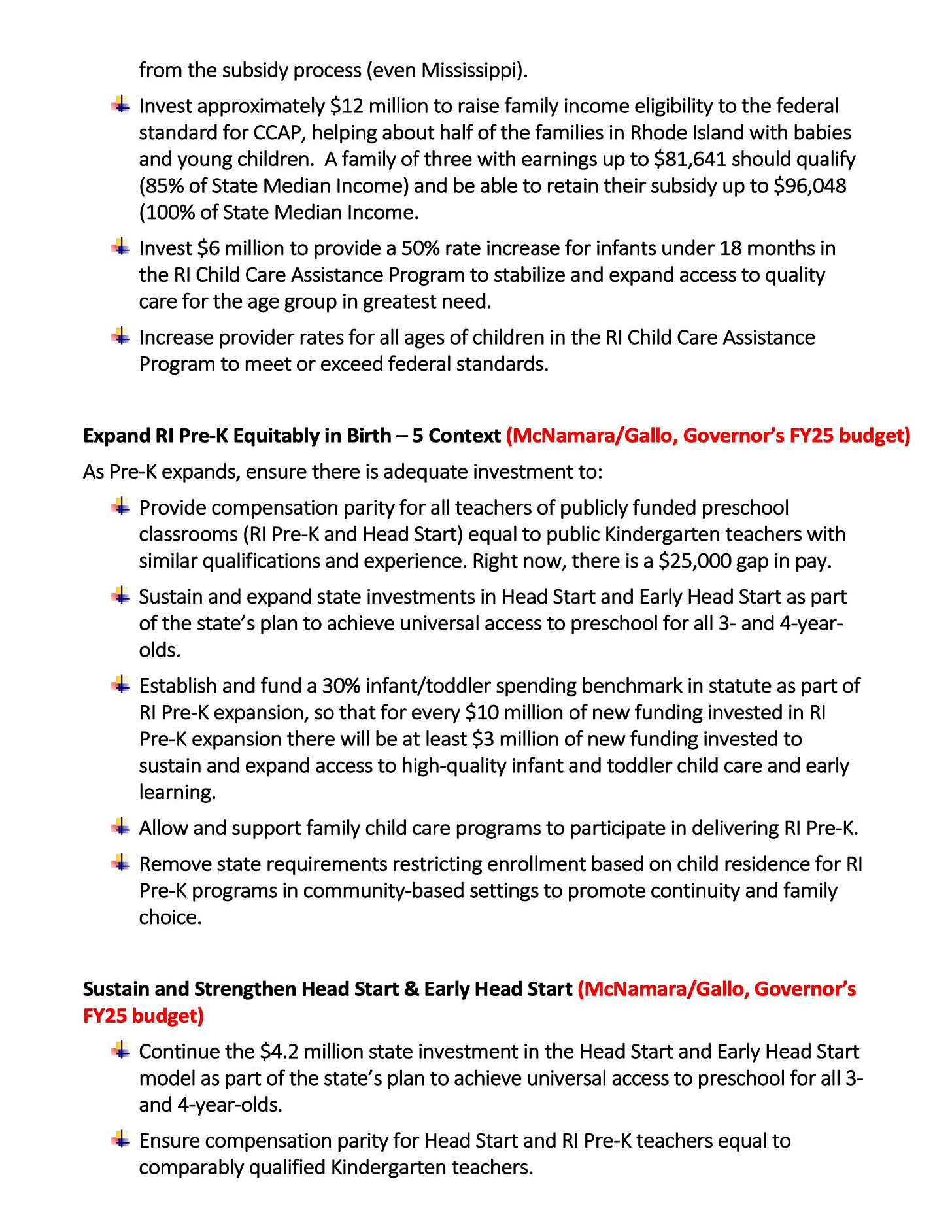

Kaitlyn Rabb, Policy Analyst at Rhode Island Kids Count, outlined Right from the Start's health and developmental priorities.

“First is the act to stabilize health coverage for young children. [Rhode Island] should join 12 other states and DC by adopting continuous Medicaid coverage for all income-eligible children, from birth through five years old. This policy helps ensure that babies and young children with Medicaid insurance, which is over 50% of Rhode Island of young Rhode Island children, have consistent access to preventative, specialized, and timely healthcare services.

“Next is ending the waiting list for the Early Intervention Program (EI) so that Rhode Island can serve every child in need. Steps to do this include providing a 25% Medicaid rate increase to fully staff EI programs, establishing an annual cost of living adjustment for the rates, and adding early intervention staff to the Childcare for Child Educators program.

“Next, establish an early childhood Infant-Toddler Developmental Assessment (IDA) task force that will create a public and private task force to develop a comprehensive financing and staffing plan to ensure that children from birth to kindergarten receive high-quality early childhood IDA services across both EI and preschool special education.

“Next is saving the Rhode Island First Connections newborn home visiting program by making the long-needed rate increase permanent for the First Connections program to prevent substantial rate cuts scheduled for July 1st. In addition, establish an annual cost of living adjustment for home visiting rates and develop a plan to sustain and expand voluntary family home visiting services so that high-quality home visiting programs are offered to all families who can benefit.

“Finally, we need to meet the mental health needs of moms and young children. [We need] to develop a plan [so] the Rhode Island Infnt and Early Childhood Mental Health Taskforce train and support professionals [can] better treat mental health challenges for young children, and also sustain the mom's PRN and PediPRN teleconsultation programs that are helping perinatal and pediatric care providers and professionals effectively manage maternal and pediatric mental health needs.”

Divya Nair, MSW, Policy Analyst at the Economic Progress Institute, outlined the priorities from an economic perspective.

“Family economic security is critical not only for maintaining financial stability for Rhode Island's diverse communities but also for the state to have a stable workforce and a thriving economy. Unfortunately, the Economic Progress Institute's Rhode Island Standard of Need report shows that most Rhode Islanders are not able to meet their most basic needs, with 70% of single parents with two children not able to meet their basic needs. Rhode Islanders value children, families, safety, and security, and our policies should reflect those values.

“This is why we need to expand our state's Paid Family Leave program to allow workers to use 12 weeks to take care of their seriously ill loved ones and bond with their new children. We also need to make sure that it's equitable by raising the wage replacement, making it equitable for minimum wage workers and essential workers, and making Rhode Island a leader once again in providing paid family leave to our families.

“Rhode Island's most vulnerable children and families need us to expand the Rhode Island Works program to ensure that they're not living in deep poverty. This includes increasing the monthly benefit amount to 50% adjusting it with inflation so it doesn't go down each year, and ensuring that children and families aren't kicked off of the program by repealing full family sanctions. [We can] also make the program more equitable by allowing legal permanent residents to have access to the same benefits as they did before 2008.

“[Lastly] we need to raise the earned income tax credit to lift hardworking Rhode Islanders out of poverty and help them move towards financial freedom. Rhode Island is severely lagging behind our neighbors in Massachusetts and Connecticut. They have 40%, we have 16% we can do better, and together we can work to make Rhode Island a better, safer, and more secure state for workers, children, and families.”

The full video is here, followed by the list of speakers:

00:00 Leanne Barrett, Senior Policy Analyst at RI Kids Count

05:00 House Speaker Joseph Shekarchi (Democrat, District 23, Warwick)

09:26 Senate Majority Leader Ryan Pearson (Democrat, District 19, Cumberland)

14:02 Lisa Hildebrand, Executive Director of the RI Association for the Education of Young Children

17:04 Rhode Island Governor Daniel McKee

23:37 Bernelle Richardson - mother and nurse

28:51 Jillian Cinquantini, Toddler Teacher at Connecting for Children and Families (CCF) in Woonsocket

31:57 Kaitlyn Rabb, Policy Analyst at RI Kids Count

35:17 Divya Nair, MSW, Policy Analyst at the Economic Progress Institute

37:55 Khadua Lewis Kahn, Executive Director of Beautiful Beginnings Child Care Center

It would be helpful to see the price tag for each initiative and the plan for how to pay for it (is the $50M from the fair share tax enough (I doubt it).