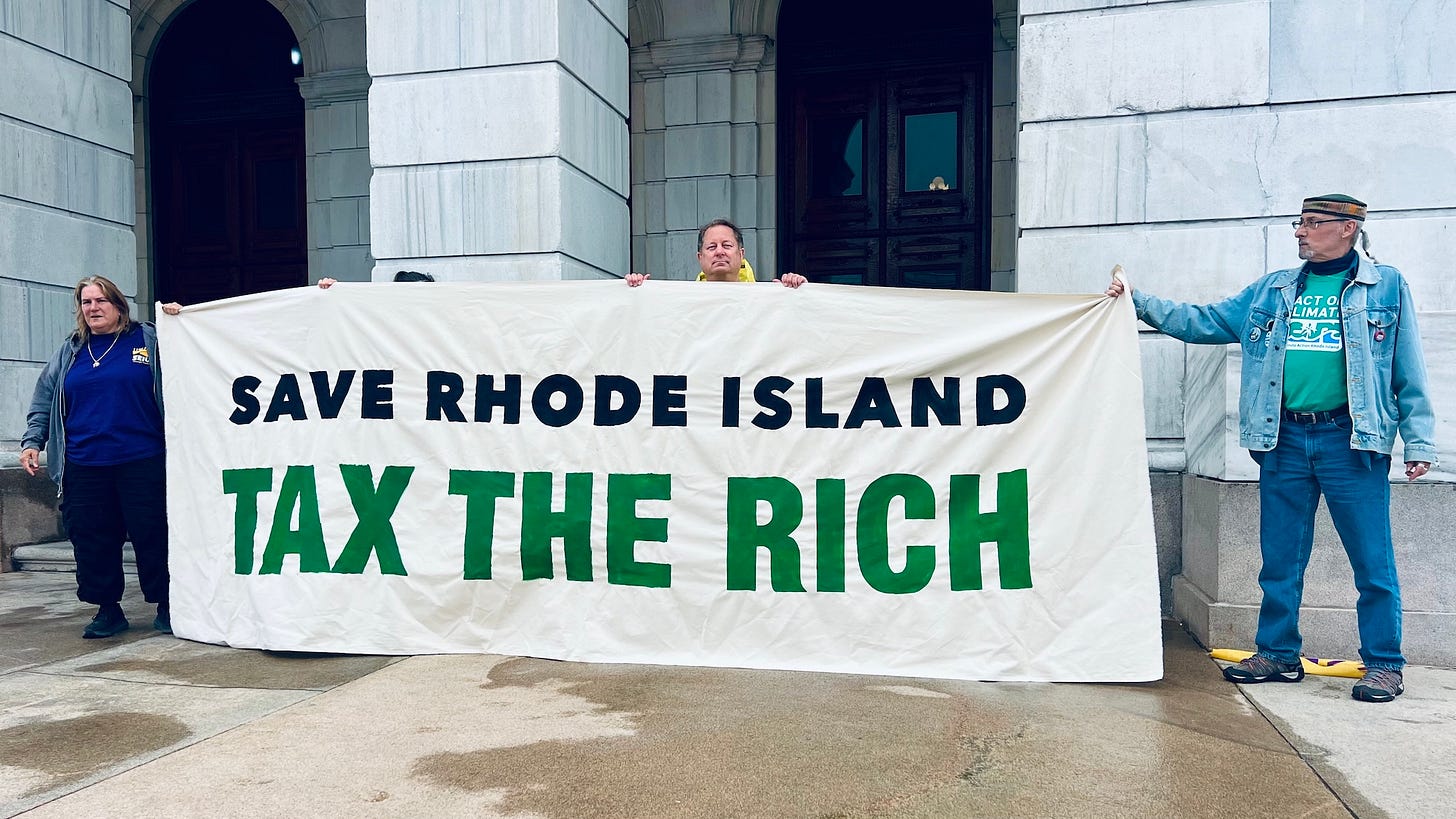

Rhode Islanders at the State House: "Tax the Rich!"

"This is not a radical idea; it’s basic fairness," said Representative Alzate. "It’s how we fund our schools, housing, healthcare, and other services."

“The time to tax the top 1% is now,” said Nina Harrison, Policy Director at the Economic Progress Institute, addressing the 150 people on the north side of the Rhode Island State House at the emergency Fair Share Tax rally. “This is not crazy. It’s reasonable, fair, and long overdue. We live in a state where the majority of single adults and single parents cannot afford to meet their basic needs without help. Working families are being squeezed harder every day by skyrocketing rents, unaffordable childcare, underfunded schools, and rising healthcare costs. Meanwhile, the top 1% have been getting richer and richer, thanks in large part to Trump’s tax breaks for the rich, which Congress is trying to make permanent.”

Harrison continued:

“Let’s be clear: Rhode Island is not broke. Our state has enough resources for everyone, but right now, they are not being taxed or shared fairly. Right now, people earning less than $23,000 a year are paying a larger portion of their income in state and local taxes than millionaires do. That’s not only backward, but also unjust and unacceptable.

“That is why we’re here today, demanding action. We’re demanding that our state legislators pass the bill that would raise $190 million a year for Rhode Island by taxing the top 1%. That tax would only apply to pre-tax income over $750,000 a year. I don’t know about you, but I don’t know anybody who makes that much money. The tax would only affect approximately 5,700 households, but more than one million Rhode Islanders would benefit from it.

“Despite what some people say, rich people will not leave the state. If this passes, they will not leave in droves. That has never happened in any state, anywhere that has passed a wealth tax like this, including Massachusetts. We haven’t seen hordes of millionaires from Massachusetts coming to Rhode Island. There’s no evidence to support such claims. They’re trying to stoke fear.

‘Massachusetts passed their millionaires tax, and they’ve raised more than $2.4 billion to add more childcare seats, free healthy school meals for all their kids, and added free bus routes. We desperately need those things in Rhode Island, and for legislators who have doubts or are on the fence, now is not the time to be overly cautious or meek.

“Now is the time for bold leadership. Now is the time to say that Rhode Island puts people over profits. In light of all the scary things we’ve been hearing on the news, we need Rhode Island leaders to show courage, because courage is contagious. We all need courage to fight for what is right, and when we fight together, we win.

“Rhode Island is watching, and we will remember where elected officials stood when they had a chance to protect us by making real change. This is urgent. We cannot afford to wait for another year or another legislative session. The time to act is now.

“We have a $250 million state budget deficit. The time to act is now.

“Rhode Island has a crisis-level shortage of affordable childcare. Nine out of 10 families cannot afford quality childcare. The time to act is now.

“Rhode Island is experiencing a crisis-level shortage of primary care physicians. I’m losing mine next month with the closure of Anchor Medical. I don’t know how many of you have had to wait months or a year to get a visit with a primary care doctor. That’s because our Medicaid reimbursement rates are too low, and we don’t have the money to increase them. Rhode Islanders need doctors. The time to act is now.

“RIPTA will have to cut services and fire drivers if they do not get the funding they need in this budget. Students and people with disabilities rely heavily on those buses. The time to act is now.

“Public schools are failing too many of our children, and they deserve better. The time to act is now. And if we don’t act now, not only are we failing our children, but we’ll also feel the consequences in our state economy later, when we need workers to fill the essential jobs in this state. Maybe they won’t be prepared because we failed them in their public education. The time to act is now.

“Our population is aging rapidly, more rapidly than most other states, and our seniors will need investment and support. The time to act is now.

“Congress is trying to cut funding for SNAP, Medicaid, and Head Start programs that are proven to work. They’re doing all of this to give more tax cuts for the rich. That’s not just wrong, it’s violent. The time to act is now.

“People, businesses, and essential workers will leave this state if we don’t have good schools, affordable housing, public transportation, or enough doctors. The time to act is now.

“The budget deficit is not a new problem. Rhode Island has been plagued by budget deficits for years, except for when it received an infusion of federal money during the COVID pandemic, and this problem will continue unless state officials step up to pass this bill. The time to act is now.

“The definition of insanity is trying the same thing over and over and expecting a different result. If we want to eliminate budget deficits and meet the needs of Rhode Islanders, we must reform our tax system to ensure everyone pays their fair share. The time to act is now.

“To our state legislators, I urge you not to balance the budget on the backs of struggling Rhode Islanders. I urge you to pass this bill, raise revenue equitably, and invest it in sectors and programs that help all Rhode Islanders have the opportunity to thrive.

“To everyone here, thank you for being courageous and thank you for showing up. Don’t stop organizing. Don’t stop speaking out. Keep calling, keep emailing. Let your voice be heard in the State House and in every room in this state where decisions are being made. The time to tax the top 1% is now. Rhode Island cannot afford to wait.”

The rally was emceed by Alisha Pina, coordinator of the Revenue for Rhode Islanders Coalition, which is made up of several labor and economic justice groups, including the Rhode Island AFL-CIO, Climate Action Rhode Island, National Education Association of Rhode Island, the Economic Progress Institute, the Rhode Island Working Families Party, SEIU-1199, Indivisible RI, and Reclaim RI.

"You want to know why there are so many co-sponsors?” asked Pina. “Because we know that this needs to pass not later, but now. We want to tax the rich now so we can get $190 million every year for the things we need and couldn’t afford.

“Rhode Islanders are struggling. The federal government is cutting vital services. Elon Musk and his cronies are securing huge tax breaks. The state is facing massive cuts to healthcare, public transportation, education, and housing. We have a state deficit, and even with the new estimates, there’s still a deficit.

“We have been working on this for six years,” concluded Pina. “In Massachusetts, it took 11 years, and you know what? The $2.9 billion they received in their first year was used to fund more childcare, MBTA improvements, and road and bridge repairs. We need all of that. We have a bridge that you can walk over faster than you can drive.”

Here’s the video:

Senator Melissa Murray and Representative Karen Alzate have been the sponsors of the bills (H5473/S0329) since they were introduced six years ago.

“We can no longer wait until next year,” said Representative Alzate. “We’re seeing what’s coming out of Washington, and we must get ahead of it before they come for us. This legislative session is almost over. If we’re lucky, we have about 30 days left. This is our last chance to do something right. We are done waiting while working people are stretching every dollar, and Butler Hospital is cutting health insurance for our friends.

“The ultra-wealthy in this state are sitting on record profits. They can afford to pay for their health insurance and so much more. This is not a radical idea; it’s basic fairness. It’s how we fund our schools, housing, healthcare, and other services. Our communities need to thrive - not only communities like mine, Pawtucket, but also wealthier communities. They will continue to thrive if we pass this legislation and make sure that they pay their fair share.

“We are no longer here to beg,” concluded Representative Alzate. “We are demanding, and we are not alone. I know that you are with me and the senator when we say it’s time to tax the rich.”

“We are at a critical time,” said Senator Murray. “We’re looking at the potential passage of the so-called ‘big beautiful bill’ with the bulk of the benefits going to the wealthiest Americans. If this bill passes, it would be the largest upward transfer of wealth in our country’s history. The wealthy have been benefiting from state and federal tax cuts for decades, and we know they will get even more tax cuts over the next four years - but at whose expense?

"This is why we need to make sure that the top 1%, the wealthiest Rhode Islanders, pay their fair share of taxes. This is about fairness. This is about equity. Everyday folks are struggling to get by and have to choose between buying groceries, paying their utilities, or paying rent. Moms are skipping meals so their kids can eat. People are skipping and rationing their medication because they cannot afford it. Families have had to double up in apartments because there aren’t enough affordable places to live. It is out of control. Enough is enough. The proposal that Representative Alzate and I have been advocating for years would generate $190 million in new revenue for our state each year.

“What could we do with $190 million?” asked Senator Murray. “We could fully fund our public schools. We could pay for meals for our kids at school. We could pay for mental health supports for kids in schools. We could bolster healthcare. We could fund the Rhode Island Public Transit Authority (RIPTA). We could do so many things. We could lift children out of poverty. We could restore the cuts to pensions. We could slash the tax on social security. We could do many things, but this bill needs to pass.

“Taxing the top 1% creates tax fairness. It addresses social, racial, and wealth inequity. This is about fairness because the millionaires and billionaires are not going to save us. This proposal can help to fund the vital programs that everyday hardworking Rhode Islanders depend on, and strengthen our state. It’s the right thing to do. The time is now.”

Tom Cute has been a bus driver and a member of ATU 618 for 45 years. ATU 618 represents workers at RIPTA.

“One of the major roles of RIPTA is to provide mobility access to those who are handicapped and cannot get on a regular transit bus,” said Cute. “This is the paratransit program, and that is going to be greatly impacted if money is not provided to cover the $32.6 million deficit. Those folks will be disenfranchised from society, including access to jobs, healthcare, and recreation. I don’t think that’s fair, and I don’t think you folks do either.

“There are 4,000 students in Providence who depend on RIPTA daily to get to school: they’re going to be disenfranchised. They’re going to have to walk, or it will be burdensome for the city to add more school buses. Some of those school buses cost as much as $600 a day.

“We are one of only two states to offer border-to-border bus service. That’s Delaware and Rhode Island. We go from Woonsocket to Westerly, and the only place we don’t operate is Block Island...

“It’s a situation that has been left to fester year after year,” concluded Cute. “Sustainable funding has not been provided to the transit system, and it is vitally needed. It’s only fair that those at the very top should share the burden to make sure that we have access to that service. It’s only fair that they pitch in and contribute more to run these operations and to save RIPTA.”

As negotiations continued between Butler Hospital workers and Care New England, a group of striking workers attended the rally.

“I’m one of the striking members at Butler Hospital,” said Gianna Piacitelli. “We’ve been on an unfair labor practice strike for over two weeks because Butler refuses to address the crisis inside our hospital: poverty wages, short staffing, and a rising epidemic of workplace violence. Many of us have been assaulted on the job. Some of us have suffered concussions, broken bones, or worse. Management still refuses to come to the table with a solution. Let me be clear: No one works at Butler to get rich. We do it because we care deeply about our patients - people facing some of the most difficult mental health challenges of their lives. We believe in this work, but belief isn’t enough to pay rent, keep food on the table, or get the medical care we need after being injured on the job.

“Butler’s president makes nearly $700,000 a year. The CEO of Care New England, Michael Wagner, earns even more, and he lives in Massachusetts, a state that already has a wealth tax. That matters because one of the arguments we hear against asking the wealthiest Rhode Islanders to pay more is that they might leave the state. But the truth is, some of the highest-paid people in our healthcare system already live in a state with a wealth tax, and they’re doing just fine.

“We’re calling for a moral budget, one that values caregivers, invests in behavioral health, and ensures that those who have the most contribute what they can,” said Gianna Piacitelli. “A moral budget means that people doing the hardest work don’t have to strike just to survive. We believe in care, we believe in fairness, and we believe Rhode Island can and must do better.”

The Rhode Island General Assembly has an estimated 20 days to pass legislation guaranteeing that the state’s highest earners pay a little more in taxes. The wealthiest 1% in Rhode Island currently pay just 8.6% of their income in taxes, while the lowest-income households pay over 13%. In Massachusetts, a similar tax that generated $2.4 billion in its first year has helped fund free school meals for students, school repairs, free bus service, and expanded public transit routes, as well as 7,000 more childcare seats, road and bridge improvements in every city and town, and more.

After the rally outside the State House, participants went inside and continued their protest. Here’s the video:

On the Butler strike: "“Butler’s president makes nearly $700,000 a year." I don't think this is accurate. According to ProPublica, she earns $542,460 plus $33,186 "other." (https://projects.propublica.org/nonprofits/organizations/50258812). This information is also available in other sources; Butler is legally required to report its income and expenses. It's also the figure the strikers have told me, and I've seen on the signs.

In any case, it's an obscene amount of money, as the wages earned by the striking workers are obscenely low (as well as having obscenely unsafe working conditions and obscenely inadequate benefits). But too much inaccurate information gets tossed around, and one thing I value so highly about Steve's blog is it is accurate or it can easily be checked.

A friend who lives in one of the housing units on the Butler Campus, wants to sympathize with the strikers but says people tell her, "you're only hearing one side of the situation." "Look it up," I told her. "Look for job openings at Butler. See what they pay. Don't take anyone's word for it." "Oh!" she said in astonishment, "oh, yes, of course!"

If somehow I've missed the other $150,000, someone please tell me--or, if she really is making that much, someone tell the IRS!

This would be a very dumb move. Which means we can count on it happening. Smith Hill is an inefficiency incubator.